Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment (including copiers, printers etc.) purchased, leased or financed during the tax year. It’s an incentive created by the U.S. Government to encourage businesses to buy equipment and invest in themselves.

This year, the deduction limit is $510,000. This means businesses can deduct the full cost of equipment from their 2017 taxes, up to $510,000, with a “total equipment purchased for the year” threshold of $2,030,000. Yes, this is a ROBUST deduction that you should take advantage of and make any purchases you are considering before December 31.

Highlights for Section 179 Tax Benefits:

2017 Deduction Limit = $510,000

This deduction is good on new and used equipment, as well as off-the-shelf software. This limit is only good for 2017, and the equipment must be financed/purchased and put into service by the end of the day, 12/31/2017.

2017 Spending Cap on equipment purchases = $2,030,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true “small business tax incentive”.

Bonus Depreciation: 50% for 2017

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. Note: Bonus Depreciation is available for new equipment only.

The above is an overall, “simplified” view of the Section 179 Deduction for 2017. For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please visit http://www.section179.org

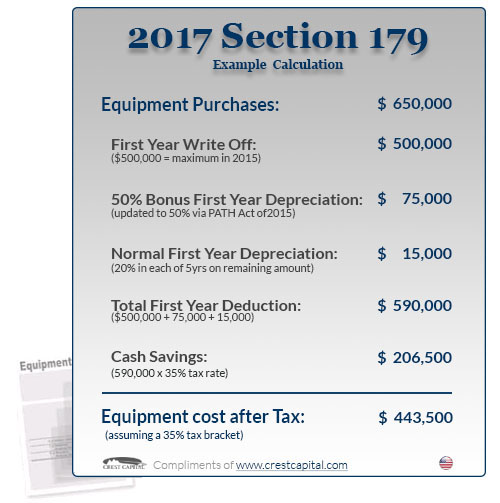

Here is an illustration of Section 179 at work during this 2017 tax year:

How much money can Section 179 save you? Try the Calculator!

Are you considering whether or not to purchase or lease equipment in the current tax year? This Section 179 Deduction Calculator for 2017 may very well help in your decision, as Section 179 will save your company a lot of money. You can test out the 2017 Section 179 Tax Deduction Calculator here: http://www.section179.org/section_179_calculator.php

You can read more information about Section 179 here or contact us today if you are ready to make a purchase, and we will assist you in getting the write-off coming to you.